Finance your Ground-up Project with Bridge

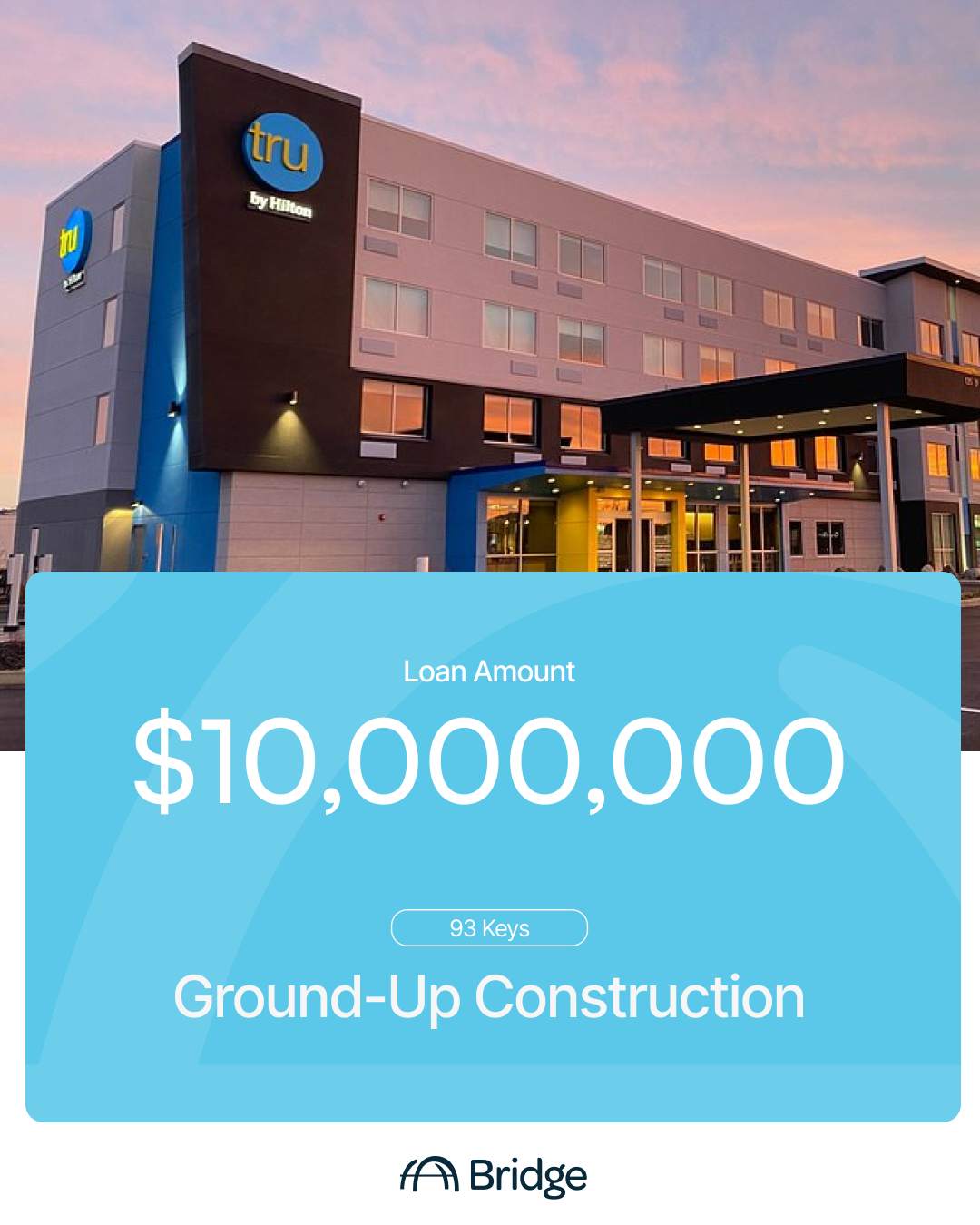

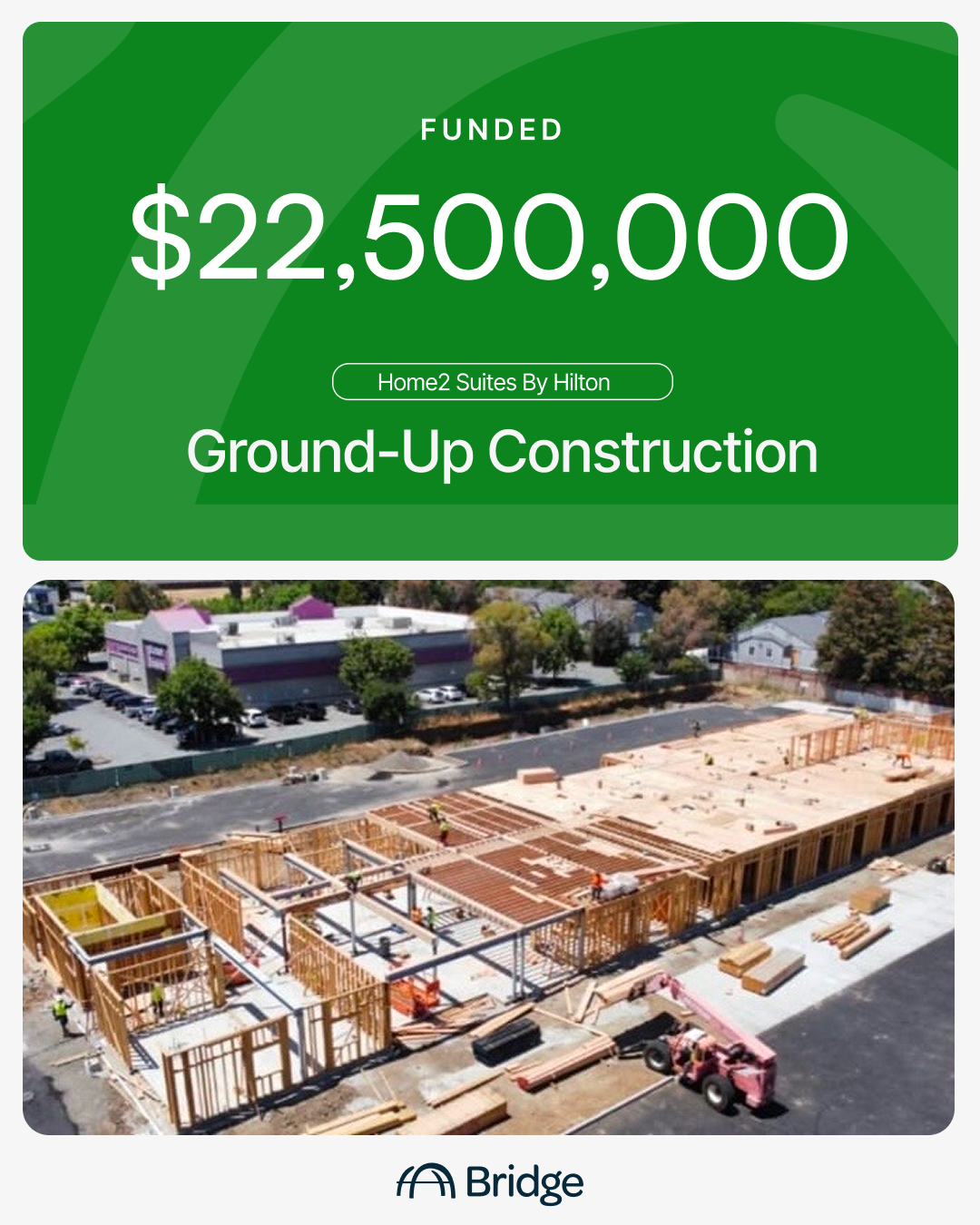

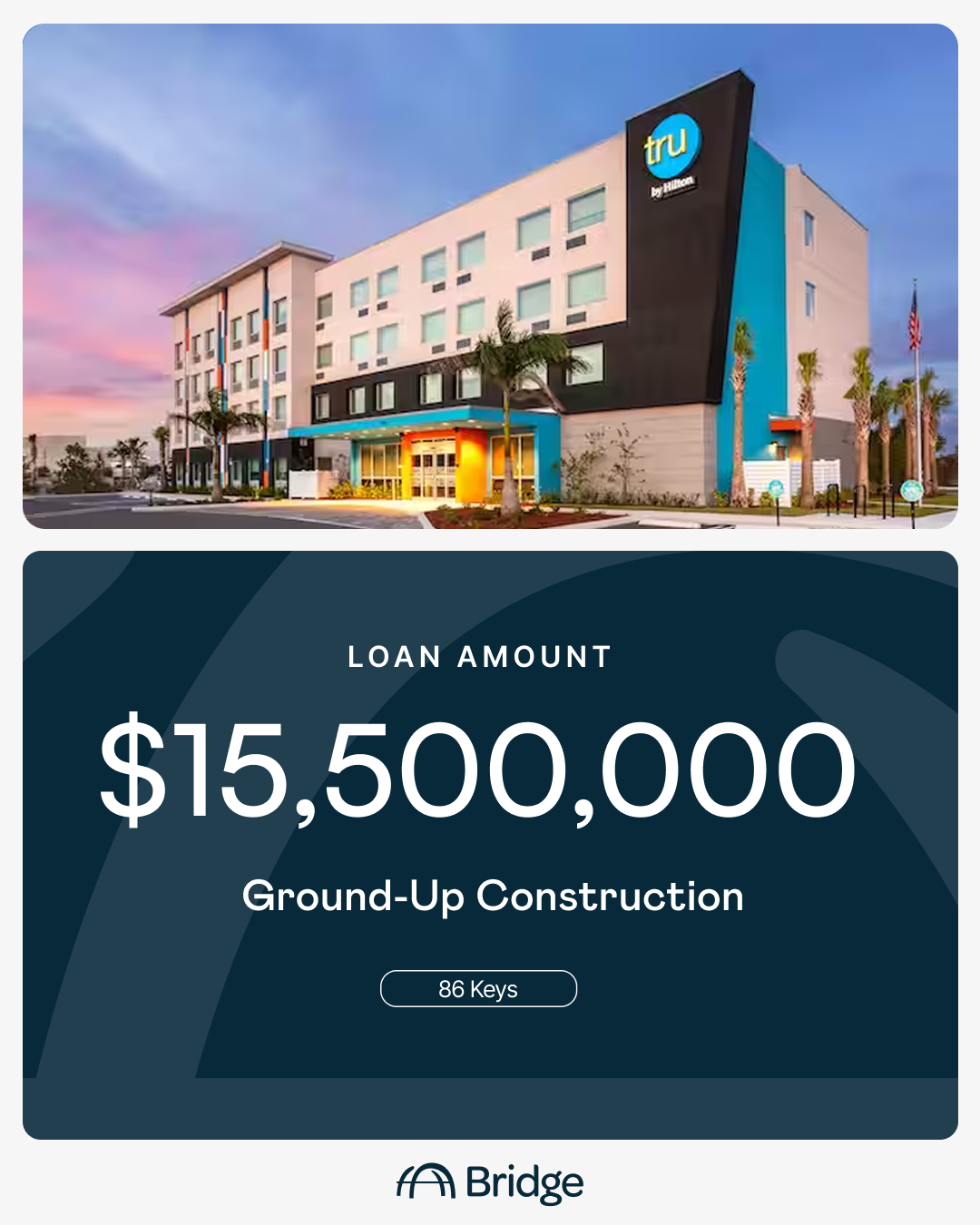

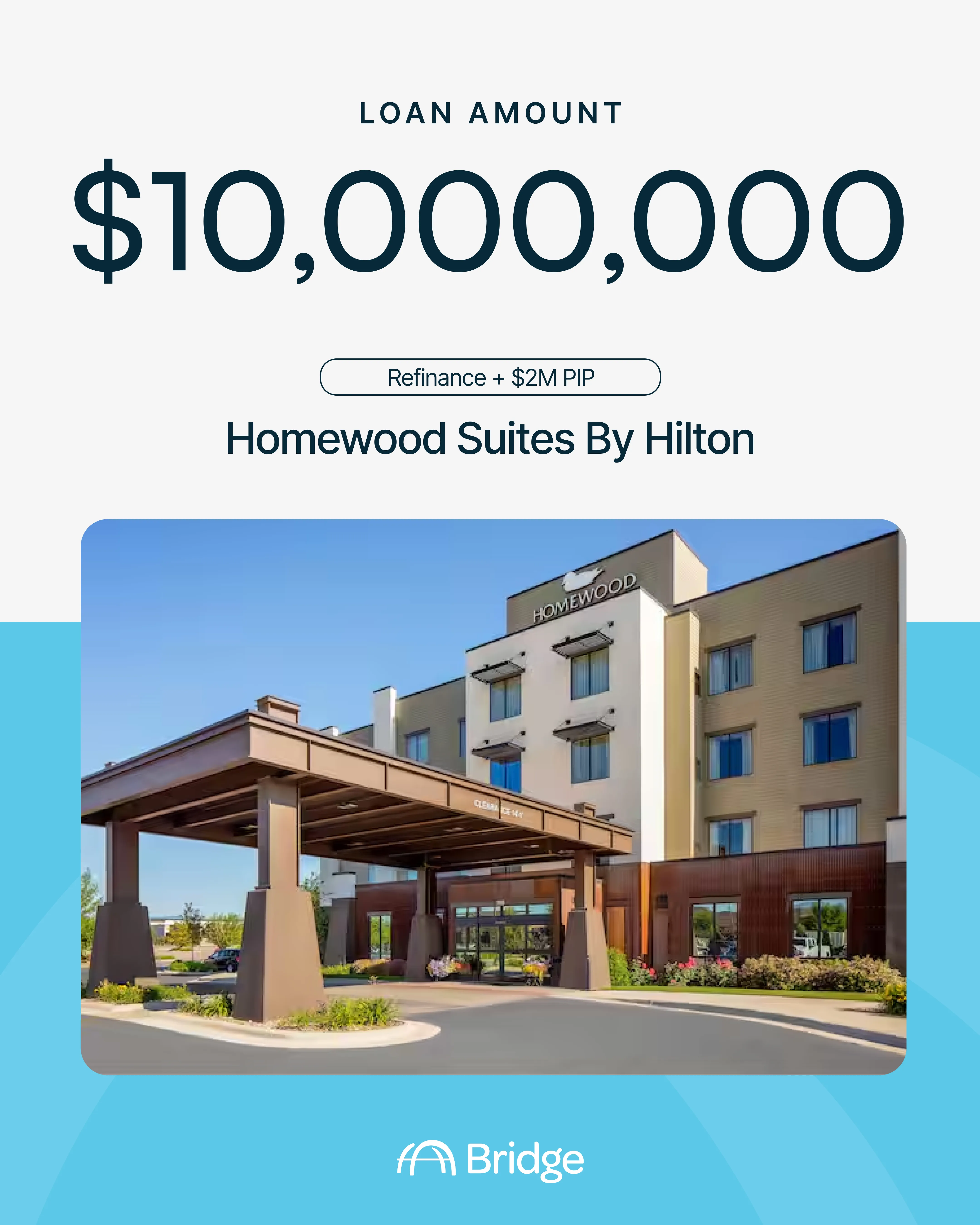

Bridge has launched a direct lending fund focused exclusively on ground-up hotel construction loans.

Program Features

Up to 75% LTC

45-60 Day Close

In-House Servicing

Is your project a fit for our Direct Lending program?

Bridge has partnered with a family office to offer direct lending powered by our in-house technology, underwriting, and post-close servicing. This program is designed to enable seasoned hotel owners, operators & developers to expand their portfolios.

loan Program parameters

Learn more about our Direct Lending program

A concise overview of Bridge’s direct lending program for new hotel construction, including loan structures, leverage, timelines, and borrower criteria.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Get APPROVAL-Ready Faster

Free Hotel Construction Budget Generator

Generate accurate Construction Budgets for your Hotel Project using MSA-specific data

Is Your Hotel C-PACE Eligible?

See instantly if your hotel can use PACE financing as “equity” under USDA and reduce how much upfront cash you need.

Ready to break ground on your next hotel?

Get StartedFrequently Asked Questions

What is Bridge’s direct lending fund for hotel construction?

Bridge’s direct lending fund provides private financing for ground-up hotel construction projects. The fund is backed by family office capital and offers flexible loan structures without the delays of traditional bank financing.

How fast can I get a hotel construction loan offer from Bridge?

Preliminary terms are typically issued within 48 hours after submitting a complete loan request through the Bridge platform.

Why choose Bridge over a traditional bank for hotel financing?

Bridge offers faster, more flexible hotel construction loans than most banks. One request connects you to capital built for hospitality, with direct access to decision-makers and no broker delays.